Real Estate Investment. It is a smart way of growing wealth, offering financial security and passive income. With smart planning, investors can earn good returns and reduce risks.

Why Invest in Real Estate?

- Property Value Increases

Property values usually go up over time. Investors can sell for a profit or use the equity for other investments. - Steady Rental Income

Renting out properties gives regular income. This helps cover costs and adds to financial security. - Diversification and Stability

Real estate balances an investment portfolio. It is more stable than stocks and protects against inflation.

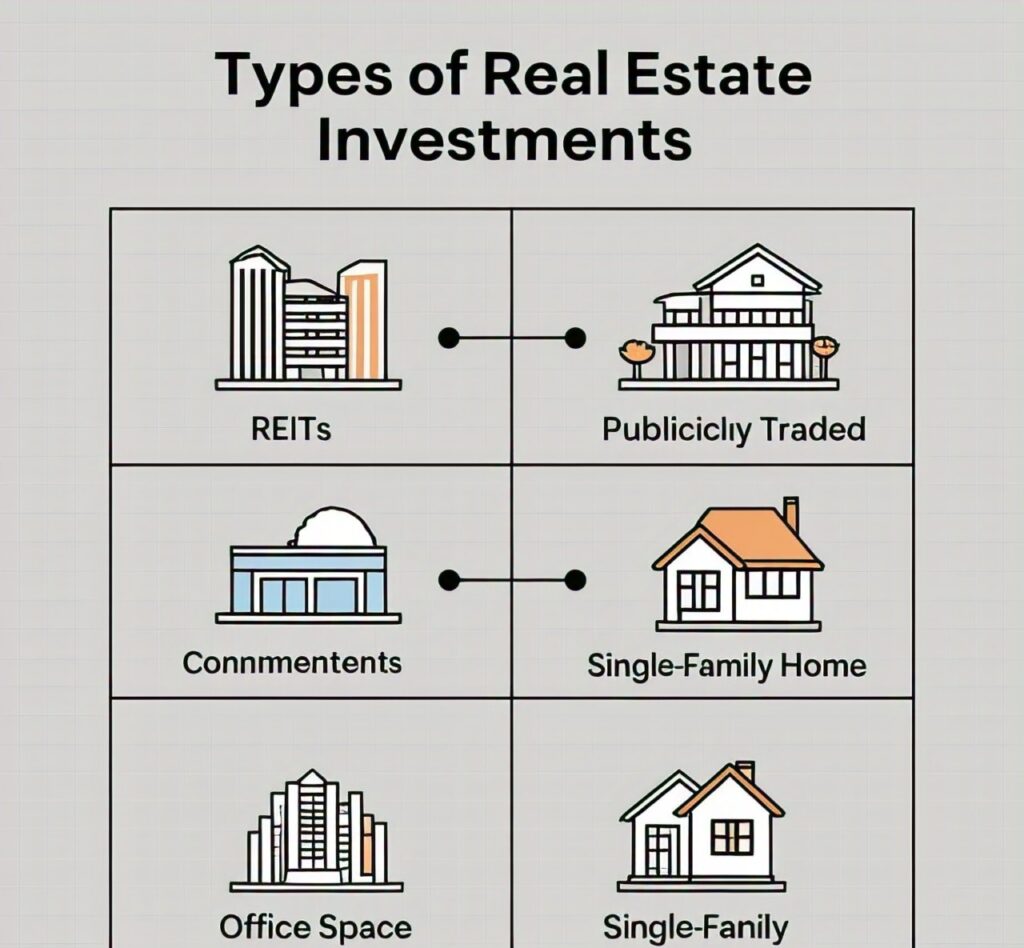

Types of Real Estate Investments

- Residential Properties

These include houses, apartments, and condos. They provide rental income or can be sold for a profit. - Commercial Properties

These are office buildings, shops, and warehouses. They offer high rental income but need careful management. - Real Estate Investment Trusts (REITs)

REITs let investors buy shares in real estate portfolios. They provide dividends without property management.

Factors Affecting Property Value

- Location and Amenities

Properties near schools, hospitals, and transport see higher value growth. Urban and developing areas are good choices. - Market Trends and Economy

Property prices change with the economy. Interest rates, inflation, and government policies affect prices. - Property Condition

Well-maintained properties attract more buyers and renters. Repairs and upgrades keep values high.

Examples of Market Price Influences

- Local Market Trends in Indore

- Pipliyahana: Prices rose by 140.9% in three years.

- Pipliya Kumar: Increased by 89.4%.

- Bicholi Mardana: Saw an 84.1% rise.

These areas show strong growth and are great for investment.

- Luxury Demand and Economic Growth

In India, luxury properties are in demand. Prices are expected to rise by 6.5% in 2025. This makes it hard for middle-income buyers but good for high-end investors. - Government Policies and Tax Cuts

Recent tax cuts aim to increase spending power. This can boost demand for housing, especially among middle-class buyers. - Interest Rates and Home Loans

The Reserve Bank of India cut the repo rate to 6.25%. Lower loan rates encourage home buying and boost property demand.

Challenges in Real Estate Investment

- High Initial Costs

Buying property requires a lot of money upfront. Investors need good credit and financing options. - Property Management

Renting out properties needs time and effort. Some hire property managers, but this lowers profits. - Market Fluctuations and Liquidity

Real estate is not easy to sell quickly. It can be hard to get cash fast, especially in slow markets.

Tips for Successful Real Estate Investment

- Research the Market

Study local prices, rental demand, and area growth. This helps in finding profitable investments. - Choose the Right Location

Pick areas with good infrastructure and growth potential. Properties near schools and workplaces are in demand. - Manage Finances and Risks

Plan for expenses like loans, taxes, and maintenance. Diversify investments to reduce risks.

Real Estate Trends in Major Cities: New York, Bangalore, and Mumbai

Understanding current real estate trends in major cities can provide valuable insights for investors and homebuyers. Here’s an overview of recent developments in New York, Bangalore, and Mumbai.

New York City

Prices for luxury homes became more competitive, starting at $4.7 million, down from $4.95 million in December 2023.

The housing market in New York City is showing positive growth as of October 2024.

In September, 1,676 properties were sold, which is a 26.4% rise compared to last year.

Manhattan experienced significant growth, with 726 sales, up by 28.7%.

The luxury property market also improved, with 70 high-end homes sold, compared to 46 in September 2023.

Source:

Bangalore

- In the first half of 2024, Bangalore made up 16% of all residential property sales in major Indian cities.

- A total of 27,404 units were sold, marking a 4% increase from the previous year.

- There is strong demand for luxury homes priced between ₹2 crore and ₹4 crore in popular areas like Indiranagar, Whitefield, and Koramangala.

- This growth is mainly driven by wealthy buyers, including company executives, startup founders, and non-resident Indians (NRIs).

Source:

Mumbai

Mumbai continues to lead India’s real estate market in both sales and new launches. In the first half of 2024, the city represented 27% of residential property sales across major markets, with 47,259 units sold, marking a 16% year-on-year increase. Luxury properties, especially those priced between ₹10 crore and ₹200 crore, are in high demand, driven by affluent buyers seeking premium amenities and prime locations. Notably, Mumbai also led in new residential launches during this period, accounting for 26% of the total share among major cities.

These trends indicate robust growth in the real estate markets of New York, Bangalore, and Mumbai, with a significant emphasis on luxury properties. Investors and buyers should consider these developments in these dynamic urban centers when making real estate decisions.

Source:

Conclusion: Is Real Estate Worth It?

Real estate is a profitable investment. It builds wealth and gives passive income. But it needs smart planning and market knowledge.

Investors can earn high returns by choosing good locations and managing finances well. Real estate remains a valuable part of any investment portfolio.

Disclaimer

This article is for informational purposes only and should not be considered financial advice.

Real estate investments carry risks, including market fluctuations and property devaluation.

Always do thorough research and consult with financial advisors before making investment decisions.

Note: If you want to learn more about Money and Finance. Do Follow my YouTube channel. themoneymindset03

Also Read: Share Market in 2025: Opportunities and Risks You Should Know